Corporate Governance

By enhancing transparency, accountability, and efficiency, strengthen the balance between management and shareholders, establish effective risk management and internal control mechanisms, to enhance long-term corporate value and promote sustainable operations.

Prudent Governance

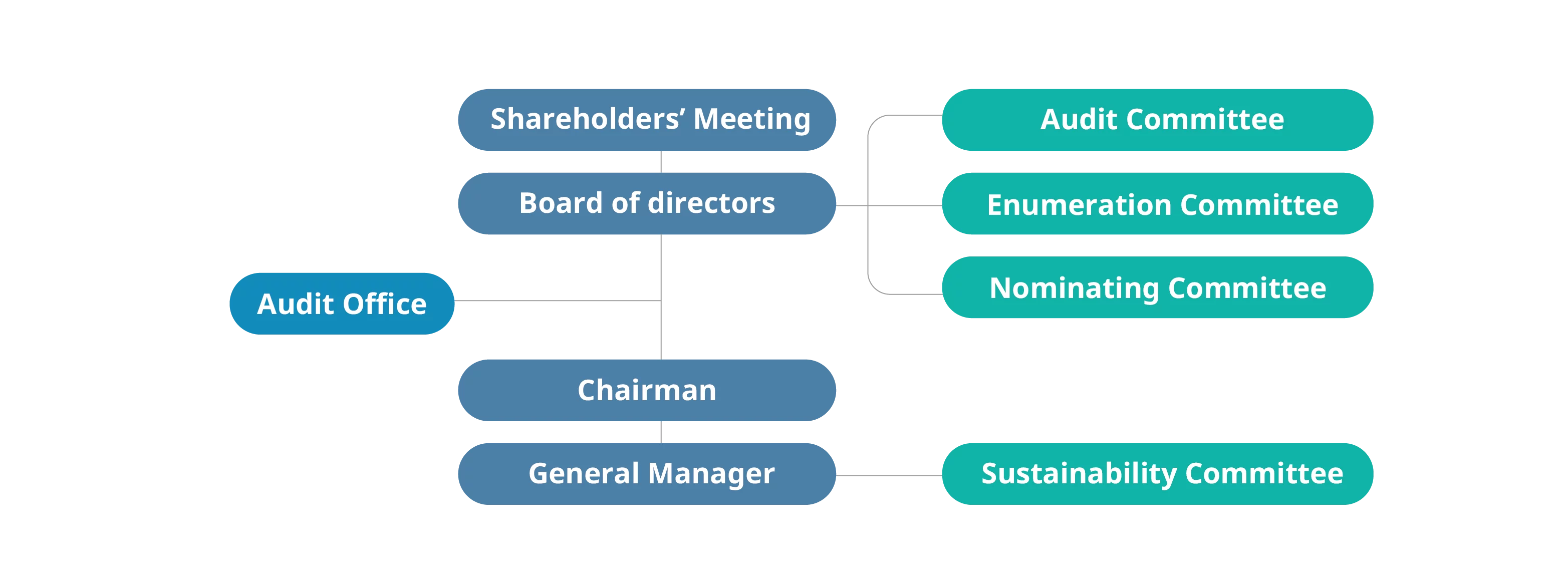

The board of directors of Phihong consists of 9 seats, including 4 independent directors, each with professional backgrounds in management, finance and accounting, business, law, and information technology. The board meets at least once a quarter to oversee internal control policies and procedures, review operational performance, and discuss major strategic issues. In 2023, a total of 13 board meetings were held, with a high attendance rate of 83.33%. During each meeting, the directors engage in thorough communication and discussions with management on the agenda items, and also provide professional advice to management as a reference for business decision-making.

Operations management, financial accounting, business, law, information technology

44.5%

Total 71 hours

| Committee | Established since | Duties | Members | 2023 Committee Operations | |||

| Required frequency | No. of Meetings | Attendance rate | Important Resolutions | ||||

| Audit Committee | 2017.6 | Supervise the proper expression of the company's financial statements, the selection (dismissal) and independence of certified accountants, the effectiveness of internal control, compliance with laws and regulations, and the management and control of the company's existing or potential risks. | 3 independent directors make up the committee, with Independent Director Yu-yuan Hung serving as chairman. | Quarterly | 9 | 97% | • Annual and quarterly financial reports • Annual budget and capital expenditure proposal • Revisions to internal control systems and management practices • Major capital loans and endorsement guarantees |

| Remuneration Committee | 2011.12 | To establish and regularly review the policies, systems, standards and structures for performance evaluation and compensation of directors and managers, and to regularly evaluate and set the compensation of directors and managers. | 3 independent directors make up the committee, with Independent Director Yu-yuan Hung serving as chairman. | Annually | 6 | 100% | • Review and adjustment of directors' operating expenses • Manager salary adjustment and yearend bonus proposal |

| Nominating Committee | 2017.8 | To nominate and confirm the qualifications of director candidates, to establish the organizational structure of functional committees, and to review the rules and regulations related to the operation of the board of directors and functional committees, and to establish and amend the code of corporate governance practices. | 3 independent directors make up the committee, with Independent Director Yu-yuan Hung serving as chairman. | Bi-annually | 3 | 100% | • Nomination of director candidates • Evaluation of Directors' Performance • Revision of the Code of Corporate Governance Practices |

| Sustainable Development Committee | 2014.12 | To coordinate the formulation of corporate social responsibility, sustainable development direction and goals, or the proposal and implementation of related management policies and specific promotion plans, and to report regularly to the Board of Directors. | The Group General Manager serves as the Chairman, with the establishment of a Sustainability Director. First-level supervisors act as conveners for the seven major sustainability themes. | Bi-annually | 12 | 100% | • Establish 47 ESG KPIs. • Approval of the 2023 ESG Major Topics and Report. • Progress report on greenhouse gas inventory for the group. |

Phihong’s compensation for directors and senior managers is governed by the “Regulations Governing the Remuneration Committee,” with individual remuneration determined based on performance self-evaluation results. The proposed compensation is reviewed by the Remuneration Committee, approved by the Board of Directors, and reported to the General Shareholders’ Meeting.

The compensation structure for the General Manager (who also serves as the Chair of the Sustainability Development Committee) and senior executives is closely linked to the company’s operational performance and personal performance indicators. Additionally, it is tied to sustainability performance metrics, encompassing aspects such as corporate governance, green design, and environmental sustainability. This alignment ensures the integration of the company’s short- and long-term business objectives with shareholder interests.

Forms can be dragged!

| Aspect | Indicators | Weight | General Manager | Seven Key Sustainability Task Forces) | ||||||

| Green Operations | Climate Change | Employee Care | Social Engagement | Corporate Governance | Supply Chain Management | Customer Partnerships | ||||

| Environmental | Low-carbon products, circular economy | 15% | V | V | ||||||

| TCFD/TNFD disclosures, carbon reduction targets | V | V | V | |||||||

| Energy and resource management | V | |||||||||

| Social | Workplace happiness evaluation (satisfaction, engagement) | V | V | |||||||

| Human rights due diligence and promotion | V | V | ||||||||

| Social welfare service promotion | ||||||||||

| Governance | Corporate governance evaluation, risk and IT management | V | V | |||||||

| Sustainable procurement responsibility | V | |||||||||

| Customer relations and satisfaction | V | |||||||||